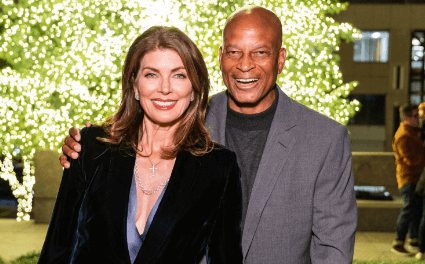

John and Shari Lott Net Worth: Financial Success Story

The financial trajectory of John and Shari Lott Net Worth serves as a compelling case study in the realm of wealth accumulation and financial management. Their journey, characterized by strategic investments and a commitment to financial literacy, yields insights into the principles that guided their success. From overcoming initial setbacks to establishing a diverse portfolio, the Lott’s story is rich with lessons on resilience and adaptability. Yet, the most intriguing aspects of their financial philosophy may lie in their approach to philanthropy and future aspirations, prompting a closer examination of what drives their continued success.

Early Life and Background

What factors shaped the early lives of John and Shari Lott Net Worth, setting the stage for their future endeavors?

Their childhood influences included strong family support and an emphasis on educational background.

Formative experiences fostered early aspirations and instilled financial literacy foundations, equipping them with the skills necessary to navigate the complexities of wealth creation, ultimately contributing to their financial success.

Initial Investment Strategies

Effective initial investment strategies are crucial for building long-term wealth, particularly through smart asset allocation that balances risk and return.

Additionally, employing diversification techniques can mitigate potential losses by spreading investments across various asset classes.

Smart Asset Allocation

An astute approach to smart asset allocation is crucial for maximizing investment returns while minimizing risk.

By understanding various asset classes and investment vehicles, individuals can enhance their financial literacy and achieve effective wealth distribution.

Monitoring market trends and economic indicators assists in retirement planning, while strategic portfolio rebalancing can create passive income through global investments, ultimately leading to sustained financial freedom.

Diversification Techniques Used

A well-structured diversification strategy is essential for mitigating risk and enhancing potential returns in investment portfolios.

Effective techniques include:

- Real Estate Investments: Providing stability and passive income.

- Stock Market: Leveraging growth through equities.

- Alternative Assets: Exploring non-traditional investments for diversification.

- Global Markets: Accessing international opportunities for broader exposure.

Utilizing these strategies can significantly enhance financial literacy and improve retirement planning outcomes.

Risk Management Strategies

Managing risk is a critical component of successful investment strategies, particularly during the initial stages of portfolio development. Effective risk assessment and financial planning involve understanding one’s risk tolerance and utilizing investment insurance. Implementing hedge strategies can mitigate impacts of market volatility, while robust crisis management and financial forecasting ensure preparedness for unforeseen events.

| Strategy | Description |

|---|---|

| Risk Assessment | Evaluating potential investment risks |

| Hedge Strategies | Techniques to offset potential losses |

| Crisis Management | Plans for unexpected market changes |

| Investment Insurance | Protecting assets against downturns |

Key Turning Points

Throughout their careers, John and Shari Lott Net Worth have encountered several key turning points that have significantly influenced their financial trajectory and professional endeavors.

These pivotal moments include:

- Identifying lucrative market opportunities.

- Making strategic investment insights.

- Implementing growth strategies during economic shifts.

- Seizing financial breakthroughs through calculated risks.

Each of these career milestones contributed to their remarkable success factors and overall financial independence.

Read also: Jose Cruz Net Worth: MLB Legend’s Financial Story

Building a Diverse Portfolio

The journey of John and Shari Lott Net Worth is marked not only by pivotal moments but also by their strategic approach to building a diverse portfolio.

They adeptly utilized real estate investments alongside mutual fund diversification to mitigate risks.

Implementing stock market strategies and incorporating alternative assets, they crafted a resilient financial framework, empowering their pursuit of freedom while maximizing potential returns in various economic climates.

Overcoming Financial Challenges

Throughout their journey, John and Shari Lott Net Worth faced significant early financial struggles that tested their resilience and determination.

By making strategic investment decisions, they were able to navigate these challenges and establish a more secure financial foundation.

Their experiences highlight the importance of adaptability and foresight in overcoming obstacles in wealth accumulation.

Early Financial Struggles

Facing a myriad of financial challenges early in their lives, John and Shari Lott demonstrated remarkable resilience and determination. They navigated significant financial setbacks through effective budgeting strategies and disciplined debt management.

Their commitment to cultivating saving habits, maintaining a healthy credit score, and establishing emergency funds ultimately paved the way for improved income sources and necessary lifestyle adjustments.

- Financial setbacks

- Budgeting strategies

- Debt management

- Saving habits

Strategic Investment Decisions

Amidst their financial challenges, John and Shari Lott Net Worth made strategic investment decisions that played a crucial role in transforming their economic landscape.

By embracing a robust investment philosophy, they leveraged market trends and economic indicators to optimize their portfolio rebalancing.

Their commitment to financial literacy enabled wealth building through diverse investment vehicles, passive income streams, and effective tax strategies, ensuring sound retirement planning.

Lessons Learned Along the Way

Navigating the complexities of financial growth and personal development, John and Shari Lott have amassed not only a significant net worth but also invaluable insights along their journey.

Key lessons include:

- Emphasizing financial education for informed decision-making.

- Cultivating an investment mindset to seize opportunities.

- Implementing effective saving strategies for wealth management.

- Prioritizing goal setting for personal growth and retirement planning.

Philanthropic Endeavors

Building upon the financial acumen gained through their experiences, John and Shari Lott have actively engaged in philanthropic endeavors that reflect their commitment to giving back to the community.

Their charitable donations and nonprofit partnerships focus on financial literacy and community outreach, enhancing social impact.

Through volunteer initiatives and grant funding, they champion advocacy efforts and sustainable giving, ensuring mission alignment with their values.

Current Net Worth Overview

Although their philanthropic efforts highlight a deep commitment to social causes, the financial portfolio of John and Shari Lott reveals a significant net worth that reflects their extensive experience in business and investments.

Key factors include:

- Diversified income sources

- Strategic wealth management

- Focus on investment growth

- Awareness of market trends

This financial stability underscores their commitment to financial literacy and wealth accumulation amid evolving economic factors.

Future Financial Goals

As they look ahead, John and Shari Lott Net Worth are focused on establishing a robust framework for their future financial goals, ensuring sustained growth and security. Their future aspirations include achieving significant financial milestones that enhance their lifestyle and provide opportunities for others.

| Goal | Timeline | Target Amount |

|---|---|---|

| Investment Expansion | 5 years | $1 million |

| Real Estate Portfolio | 10 years | $3 million |

| Philanthropic Endeavors | 3 years | $500,000 |

Read also: Steve Steinour Net Worth: CEO’s Career Earnings

Conclusion

The financial journey of John and Shari Lott Net Worth underscores the adage, “Fortune favors the bold.” Their strategic investment decisions and commitment to financial literacy have not only cultivated significant wealth but also fostered resilience in overcoming challenges. By embracing diversification and philanthropy, they have established a legacy that transcends mere financial success, inspiring others to pursue their own paths to prosperity. The Lott’s story serves as a reminder that adaptability and informed choices are pivotal in achieving lasting financial success.