White Oak Global Advisors: A Deep Dive into an Alternative Investment Giant

In the complex and dynamic world of alternative investments, White Oak Global Advisors has carved out a significant niche. Founded in 2007, this San Francisco-based investment firm specializes in providing private credit to middle-market companies, offering tailored financial solutions that traditional lenders might overlook. With a robust track record and a dedicated team of professionals, White Oak has become a formidable player in the financial services industry.

The Genesis and Growth of White Oak Global Advisors

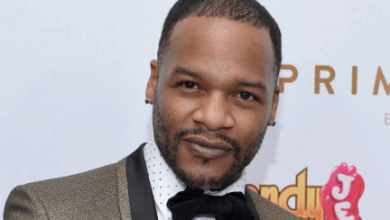

White Oak Global Advisors was established by Andre Hakkak and his team with a clear vision: to bridge the financing gap for middle-market businesses that are often underserved by conventional banks. The firm’s name, White Oak, symbolizes strength and stability, reflecting its commitment to providing dependable financial support to its clients.

The company’s growth trajectory has been impressive. From its inception, White Oak has expanded its footprint, managing over $6 billion in assets and offering a diverse range of financial products. The firm has built a reputation for its expertise in structuring complex deals and its ability to deliver consistent returns to its investors.

Core Investment Strategies

White Oak’s investment strategies are centered around three main pillars: direct lending, asset-based lending, and specialty finance. Each of these strategies is designed to cater to the unique needs of middle-market companies, providing them with the necessary capital to fuel their growth and navigate challenging financial landscapes.

Direct Lending

White Oak’s direct lending strategy focuses on providing senior secured loans to companies across various industries. These loans are typically used for growth capital, acquisitions, refinancings, and recapitalizations. The firm’s rigorous underwriting process ensures that each loan is tailored to the specific needs of the borrower while maintaining a strong emphasis on capital preservation and risk management.

Asset-Based Lending

In asset-based lending, White Oak offers loans that are secured by a company’s assets, such as inventory, accounts receivable, and equipment. This strategy allows businesses to unlock the value of their assets to obtain much-needed liquidity. White Oak’s expertise in asset valuation and collateral management is a key differentiator in this space, enabling the firm to provide flexible and innovative financing solutions.

Also read – Andre Hakkak Net worth

Specialty Finance

Specialty finance is another critical component of White Oak’s investment approach. This strategy encompasses a wide range of financial products, including trade finance, leasing, and structured finance. By leveraging its deep industry knowledge and extensive network, White Oak can offer customized solutions that address the unique challenges faced by middle-market companies.

A Client-Centric Approach

White Oak’s success can be attributed to its client-centric approach. The firm takes pride in building long-term relationships with its clients, understanding their specific needs, and providing tailored financial solutions. This commitment to client service is evident in the firm’s meticulous due diligence process, which involves a thorough analysis of each company’s financial health, market position, and growth potential.

The firm’s team of experienced professionals works closely with clients to structure deals that align with their strategic objectives. This collaborative approach ensures that clients receive the necessary support and guidance to achieve their business goals. White Oak’s ability to adapt to changing market conditions and tailor its offerings to meet the evolving needs of its clients has been a cornerstone of its success.

Impact and Community Engagement

Beyond its financial achievements, White Oak Global Advisors is also committed to making a positive impact on the communities it serves. The firm actively engages in various philanthropic initiatives, supporting organizations that promote education, healthcare, and social welfare. By leveraging its resources and expertise, White Oak aims to create meaningful and lasting contributions to society.

Risk Management and Compliance

In the realm of alternative investments, risk management and compliance are paramount. White Oak Global Advisors has established a robust framework to mitigate risks and ensure compliance with regulatory requirements. The firm employs a comprehensive risk management strategy that includes rigorous due diligence, ongoing monitoring of portfolio companies, and stress testing.

White Oak’s compliance program is designed to adhere to the highest standards of regulatory oversight. The firm continuously updates its policies and procedures to align with evolving regulatory landscapes, ensuring that it operates with integrity and transparency. This commitment to risk management and compliance not only protects the firm’s investors but also enhances its reputation in the market.

Technological Integration

In an era where technology is reshaping the financial services industry, White Oak Global Advisors has embraced innovation to enhance its operations and service offerings. The firm leverages advanced analytics, machine learning, and data-driven insights to inform its investment decisions and optimize portfolio performance. This technological integration enables White Oak to identify emerging trends, assess risks more accurately, and deliver superior outcomes for its clients.

The Road Ahead

As White Oak Global Advisors looks to the future, the firm remains focused on its mission to provide innovative and reliable financial solutions to middle-market companies. The firm is poised to capitalize on new opportunities in the alternative investment landscape, driven by its commitment to excellence and its ability to adapt to changing market dynamics.

White Oak’s strategic vision includes expanding its global footprint, exploring new investment strategies, and continuing to enhance its technological capabilities. By staying true to its core values of integrity, innovation, and client-centricity, White Oak is well-positioned to navigate the challenges and opportunities that lie ahead.

Conclusion

White Oak Global Advisors stands out as a leader in the alternative investment space, with a proven track record of delivering consistent returns and providing customized financial solutions to middle-market companies. The firm’s success is built on a foundation of rigorous risk management, technological innovation, and a deep commitment to client service.

As the financial landscape continues to evolve, White Oak’s ability to adapt and innovate will be crucial in maintaining its competitive edge. With a dedicated team of professionals, a client-centric approach, and a strong focus on community engagement, White Oak Global Advisors is not only shaping the future of alternative investments but also making a positive impact on the world around it.